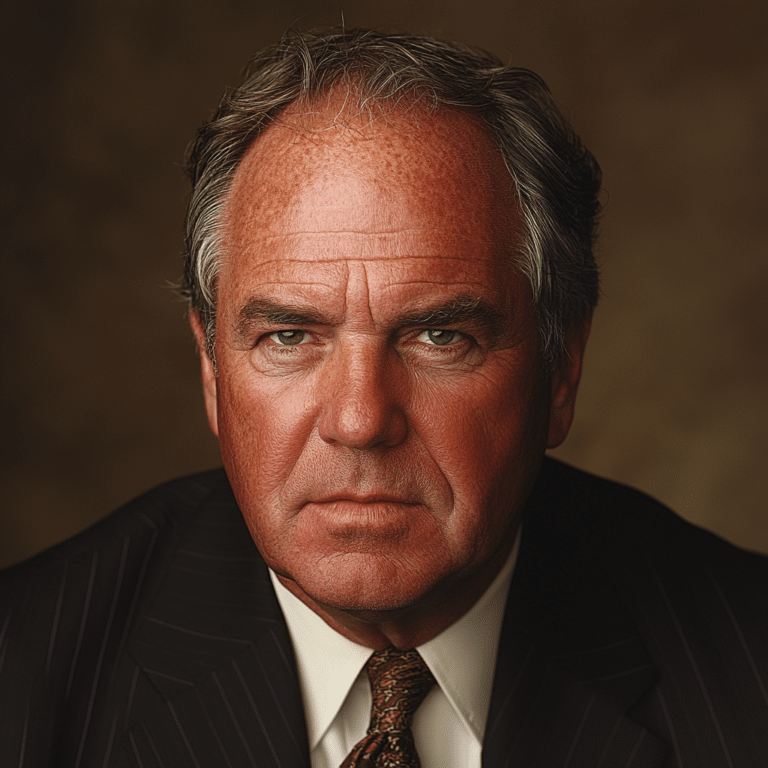

When you hear the name William Ackman, you might think of sharp suits, slick investment strategies, and a knack for turning overlooked companies into gold mines. As the founder and CEO of Pershing Square Capital Management, Ackman has made quite a splash in the investment community since he first launched his hedge fund back in 2004. With $15 billion in assets under management, Ackman has become a household name for those who follow the twists and turns of Wall Street. So, what’s the secret sauce behind William Ackman’s success? Let’s dive in!

Top 7 Strategies Behind William Ackman’s Investment Success

1. Activism and Influence

Ackman’s style isn’t just about waiting for a stock to rise; he’s all about shaking things up! His activist investing method means he buys significant stakes in companies and then gets vocal about making changes. Take his infamous campaign against Herbalife, for instance. It wasn’t just a money play; it kicked off a firestorm of discussions about their business model. Just like that moment in Gilligan’s Island where the crew tries to fix their boat—one strong voice can steer a conversation in a whole new direction.

2. Strategic Partnerships

Networking in finance can be as crucial as the money itself. Ackman knows this like the back of his hand! He’s formed alliances with a variety of industry players, including director Howard Deutch, who’s celebrated for films like “Pretty in Pink.” Teaming up with folks from different fields, like entertainment, opens doors for fresh insights and unique investment opportunities. It’s a bit like brainstorming a screenplay—collaboration often breeds the best ideas!

3. Talent Acquisition

Bringing in the right talent can be the difference between a flop and a blockbuster. Ackman has a knack for attracting top-notch analysts who help him scour the market for those elusive gems. Think of it as casting; just as Jonathan Glazer brings exceptional talent to his films, Ackman pulls together a stellar team. Every member adds their expertise, helping him uncover investment options others might miss.

4. Risk Management

Ackman is practically a wizard when it comes to managing risk. A prime example? His investments during the Covid-19 pandemic, where he expertly navigated the chaos and jumped into the likes of restaurant chains and healthcare stocks. Much like Max Burkholder, who effortlessly shifts between genres in acting, Ackman skillfully balances high-risk opportunities. His ability to foresee market trends ensures he’s not just riding the waves but also shaping them.

5. Long-Term Vision

The secret behind Ackman’s success isn’t just short-term gains; it’s all about seeing the big picture. He often looks for companies with growth potential over the years. Just like Lahmard Tate focuses on finding the right roles that’ll elevate his career in film and TV, Ackman goes for investments that won’t just make a splash but offer sustainable returns. His long-term belief in giants like Starbucks underlines the power of patience and strategic planning.

6. Focus on Value Creation

Creating value is at the heart of Ackman’s investment approach. He knows that improving operational efficiency pays off big-time when it comes time to sell. This mirrors what filmmakers like Herschel Weingrod do—they craft stories that resonate and captivate audiences. By enhancing the companies he invests in, Ackman seeks to maximize his returns efficiently and effectively, similar to how a good movie keeps viewers hooked from start to finish.

7. Emotional Resilience

The pressures of the financial world can drive even the toughest investors bananas. But not Ackman! His ability to stay cool under fire mirrors how seasoned actors like William Fichtner manage the scrutiny of the film industry. When volatility strikes, he keeps his composure, watching trends rather than triggers, which helps guide him through the uncertain seas of the stock market.

As 2024 kicks off, William Ackman continues to demonstrate how savvy thinking paired with a solid network can lead the charge in the finance world. With his focus on value, strategic partnerships, and long-term goals, Ackman shines as a beacon in a sometimes stormy sea. For many investment enthusiasts, he’s living proof that with the right approach, financial success isn’t just a dream; it’s a possible destination.

Whether you’re a Wall Street maven tracking market performances or a novice investor looking for inspiration, it’s clear that following William Ackman’s journey can provide invaluable lessons. After all, in investing, as in filmmaking, it often takes a unique blend of vision, strategy, and a touch of daring to turn a great story into a blockbuster success!

William Ackman: A Financial Dynamo

Unforgettable Moments and Surprising Connections

William Ackman isn’t just known for steering Pershing Square’s impressive success; he’s also got some intriguing connections to pop culture! Did you know that before becoming a legendary investor, Ackman hosted a charity gala that featured the likes of the cast from Law and Order? Now that’s a crossover that would get any legal drama fan excited, just like the classic island antics we see in Gilligan’s Island. These events show Ackman’s charm extends beyond Wall Street, highlighting his knack for bringing influential figures together.

Numbers, Career Moves, and Hollywood Éclat

Ackman’s career is rife with bold moves that haven’t just changed companies but have also drawn attention from movie buffs and trendsetters alike. His firm’s early investments often had him compared to the iconic role of a hero in a classic Tom Holland movie, fighting against the odds. This lovable character faces challenges but never backs down—much like Ackman in the unpredictable world of finance. Just as a Loan servicer juggles client needs, Ackman balances multiple high-stakes investments with an enviable flair.

Cinema Screens and Business Savvy

Speaking of cinema, did you know the excitement isn’t just limited to his business breakthroughs? Some recent projects have brought the thrill of investment to the big screen, compellingly reflected in venues like the Alpine Cinema and Cinemark Downey. You could grab a popcorn and dive into a business documentary that mirrors the strategies Ackman has used. Furthermore, his interactions with rising investors like Harper Zilmer show the continuous turnover of talent in finance. It’s sort of like how Freedom Cash Lenders help aspiring homeowners achieve dreams, Ackman paves the way for a new generation of investors eager to learn from the best.

In the whirlwind ride that is the market, William Ackman remains a standout figure, intertwining finance with elements of popular culture and community engagement, proving once again that success doesn’t have to be serious all the time!

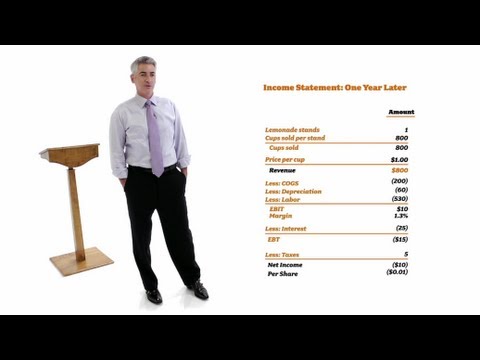

How did Bill Ackman make his money?

Bill Ackman made his money through successful investments as the founder of Pershing Square Capital Management, especially with notable trades like his short of bond insurer MBIA and investments in companies like General Growth Properties.

How much does Bill Ackman make per year?

In 2023, Bill Ackman appears to have made at least $600 million, thanks to the strong performance of his hedge fund, which rose by 26.7% on a net basis that year.

Does Bill Ackman have an MBA?

Yes, Bill Ackman has an MBA from Harvard Business School, where he received his degree in 1992 after earning a Bachelor of Arts magna cum laude from Harvard College in 1988.

Who is Bill Ackman’s dad?

Bill Ackman’s father is William Ackman, who was a successful CEO and the founder of Ackman Brothers & Singer, Inc., a real estate investment banking firm.

What is Bill Ackman’s strategy?

Ackman’s investment strategy often involves concentrating on a few high-conviction positions, focusing on fundamentally undervalued companies, and using a mix of activism to drive changes at those firms.

Does Bill Ackman own crypto?

Bill Ackman has expressed interest in cryptocurrency but it’s not clear if he holds any significant positions in the market.

Who is the greatest hedge fund manager?

There’s no universally agreed-upon greatest hedge fund manager, as it often depends on various criteria, but many consider figures like Warren Buffett and Ray Dalio among the best, along with Ackman himself.

Is Bill Ackman a good investor?

Many see Bill Ackman as a good investor, given his history of successful trades and the notable returns from his hedge fund, but opinions can vary in the investment world.

What companies does Bill Ackman hold?

Ackman’s fund, Pershing Square Capital Management, holds stakes in various companies, including Domino’s Pizza and Chipotle, among others, though specific holdings can change over time.

Does Bill Ackman own Starbucks?

No, Bill Ackman doesn’t own Starbucks, but he has been known to evaluate investments in various consumer-oriented companies, including those in the food and beverage sector.

What did Bill Ackman major in college?

In college, Bill Ackman majored in social studies, and his thesis covered the experiences of Jewish and Asian American students in Harvard admissions.

Does Bill Ackman own Netflix?

No, Bill Ackman does not own Netflix, although he has invested in various other media and technology companies throughout his career.

How to start a hedge fund?

Starting a hedge fund typically involves having a strong financial background, creating a solid investment strategy, registering with regulatory bodies, and raising capital from investors.

Who is Ryan Israel?

Ryan Israel is a partner at Pershing Square Capital Management, contributing to the firm’s investment strategies and operations under Bill Ackman’s leadership.

Who is the CEO of Pershing Square?

The CEO of Pershing Square Capital Management is Bill Ackman himself, who founded the hedge fund and continues to manage its investments and strategies.