As 2024 unfolds, we’re stepping into a landscape of surcharge news that consumers need to understand. From banking services to entertainment subscriptions, fee changes are popping up like weeds in a garden. Ain’t it just a joy when those unexpected costs creep in? Whether you’re an everyday consumer or a business owner, tracking these developments can help save your wallet from those pesky extra charges. Let’s break it down and figure out how to navigate this maze of fees together!

Top 7 Surcharge News Trends Reshaping Your Wallet

1. Banking Fees Reimagined

Big players like Bank of America and Chase aren’t holding back in 2024. They’ve introduced hefty monthly maintenance fees—if you’re not balancing your account just right. On the flip side, some offer waivers if you keep a minimum balance, creating a game where every dollar counts. It begs the question: Are people really loyal to banks that pinch pennies? Would you prefer to go for alternatives with less baggage?

2. Streaming Services Spike

In the world of binge-watching, giants like Netflix and Disney+ are upping their game with subscription price hikes. But wait, there’s more! They’re also adding surcharges for premium content and ad-free experiences. As folks start tightening their budgets, the question becomes clear: Is premium content worth a higher price tag? With so many options at our fingertips, consumers are definitely feeling the heat.

3. Rising Utility Charges

Let’s shine a light on another area: utility bills. Companies like Pacific Gas and Electric are slapping on extra fees for using green energy. Sure, we love saving the planet, but when it hits our wallets, the love starts to fade. Families already struggling with escalating energy costs, thanks to winter heating bills, may find these new surcharges downright unfair.

4. Unexpected Airline Fees

Air travel just got even pricier! In 2024, both United Airlines and American Airlines have added surcharges for checked bags and seat selections. They claim these extras are “operational necessities.” Meanwhile, travelers are left scratching their heads, saying, “Ain’t flying supposed to be fun?” Expect your dream getaway to cost you significantly more than the ticket price alone.

5. E-commerce and Delivery Fees

Big ol’ Amazon isn’t immune to this surcharge news either. They’ve introduced new delivery surcharges for certain neighborhoods, especially around busy seasons. If you thought online shopping was exempt from such fees, think again. Consumers now have to be savvy about those added costs sneaking into their checkout carts. Planning to snag a gift? Check that total carefully!

6. Parking and Tolls

Cities are also getting in on the surcharge action. In locales like New York and San Francisco, new fees for parking and tolls are popping up, all in the name of funding infrastructure projects. With dynamic pricing models hitting the scene, things are getting pricier during rush times, stirring community debates. Are we really giving cities a free pass to drain our wallets? It’s worth pondering!

7. Restaurant Service Charges

Restaurants are jumping on the surcharge bandwagon as well. Many eateries, from chain giants like Olive Garden to local favorites, are tacking on extra fees to offset rising costs. The trade-off becomes a crucial topic, especially for those dodging decisions on how much to tip. Should we adapt our tipping habits, or is price transparency the way to go?

Understanding the Implications of Surcharge News

With these changes in the surcharge news, the implications stretch far and wide. These fee structures impact not only your wallet but also consumer behavior and market trends. As they reshape the way we spend, let’s explore a bit deeper.

Consumer Behavior Shifts

With all these rising fees, many customers are adjusting how they spend. Surveys show that more folks are now leaning towards local businesses instead of big corporations. There’s a growing demand for transparency about pricing too, with 67% of people preferring brands that are upfront about their fees. After all, isn’t it nice to know where every penny is going? Consumers are talking, and businesses better listen!

The Competitive Landscape

This landscape is also changing how businesses operate. Smaller banks, for example, have a golden opportunity to lure clients away from the big players by offering fee-free services. It’s refreshing to see these new strategies aimed at customer satisfaction. If larger banks want to keep their clientele, they’ll likely need to rethink their fee structures or amp up their game when it comes to customer service.

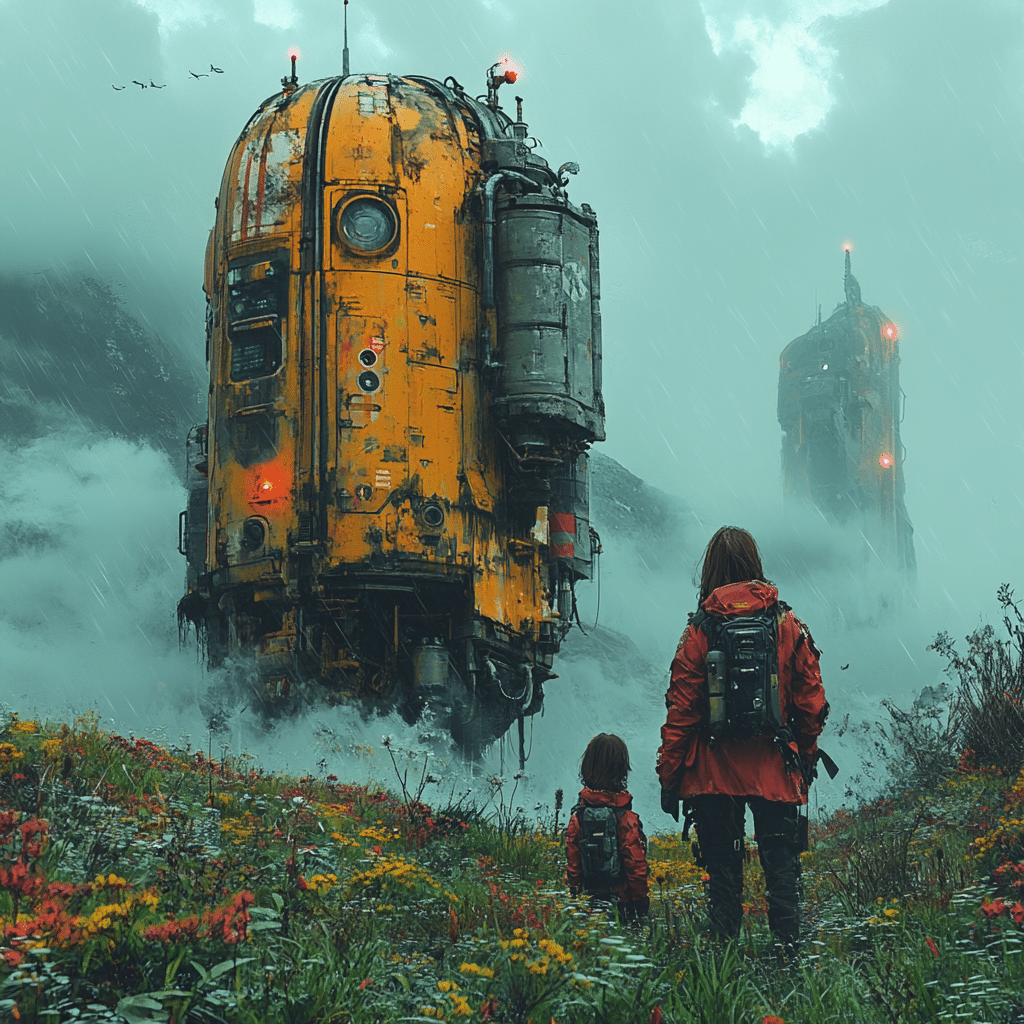

A Glimpse into the Future

Keeping an eye on these trends will help predict how industries will adapt to the ever-changing landscape bent on inserting surcharges. In 2024 and beyond, companies exploring innovative strategies—like bundling services or subscription models—may just find themselves ahead of the curve. Consumers are ready to take charge of the narrative, making informed choices about where their money goes.

In a world where fiscal responsibility is key, being aware of the surcharge news is essential. We’ll need to delicately balance cost with value moving forward. For those businesses that can adapt, opportunities abound, especially in a marketplace increasingly leaning toward transparency and integrity.

So, buckle up! The future of fees might still be a wild ride, but staying informed and proactive will definitely put you in the driver’s seat. Let’s make those expenditures work for us!

Surcharge News: The Latest Fee Changes Nationwide

Surprising Stats in Surcharge News

Surcharge news has been making waves as new fees pop up across the country in the wake of rising costs. Did you know, according to a recent study, that 80% of consumers are unaware of additional charges? This reality might make you feel like you’re walking through a maze trying to pick the best deals. Some folks end up paying more just because they didn’t catch those pesky extra fees. For example, just like you’d prefer to know How tall Is Tara yummy before heading to a concert, knowing about surcharges can save you a pretty penny!

Why Fees Are Changing

From service providers to retail giants, everyone seems to be playing the fee game. Companies like Malbon Golf have been open about their costs, which is refreshing in this ever-shifting economic landscape. Keeping tabs on the 10yr treasury can give you insights into future rates and market trends, reminding us that these fees might stick around longer than we think. With inflation lurking in the background, these shifts in surcharge news indicate that businesses may be trying to keep their heads above water while consumers foot the bill for extra services.

What’s Next in Surcharge News?

As all this plays out, some agencies are stepping up to help folks stay informed. The Tcaa Speaker Agency is offering valuable sessions aimed at educating the public regarding fees, making sure everyone understands what they’re getting into. And just like Friends orange has become a go-to phrase for maintaining positivity, staying informed about surcharge changes can keep your finances in check. In this dynamic environment, being aware of fee trends ensures you’re better equipped—so don’t let that surcharge news catch you off guard!