The world of investment is buzzing with a dynamic and thriving community that has found a digital campfire around which to gather — the SPY Stocktwits platform. For those who are uninitiated, SPY Stocktwits is a burgeoning online hub where enthusiasts, traders, and investors share insights, speculations, and strategies related to the SPDR S&P 500 ETF Trust, commonly known by its ticker symbol SPY. In this well-drawn exploration, we dive into the crazed intricacies of this platform and unearth insights that reveal the heartbeat of not just a community, but also potentially that of the broader stock market.

The Burgeoning Community of SPY Stocktwits Enthusiasts

The SPY Stocktwits community is a veritable smorgasbord of market sentiment, where the bullish and the bearish lock horns daily. Navigating through the platform, it’s like stumbling upon a Wall Street trading floor gone digital — teeming with energy, emotion, and edge-of-your-seat speculation.

SPY Stocktwits has seen a meteoric rise in user growth, boasting a demographic blend as diverse as a bustling metropolitan subway. Millennials and Gen Zers mingle with seasoned investors, embracing the egalitarian swap of information that knows no age.

What’s the hook? The allure of SPY Stocktwits is as multifaceted as a well-cut diamond. Some come seeking the camaraderie of kindred spirits, while others are on the hunt for the next juicy tidbit that could give them an edge. It’s the digital age’s answer to the traditional investment club, and it’s as exhilarating as a double shot of espresso.

Navigating the Rhythms of SPY Stocktwits Sentiment

Sentiment analysis on SPY Stocktwits is akin to taking the market’s emotional temperature. Investors use a variety of tools to sift through posts and gauge whether the mood is exuberant or despondent, which can often be a tell-tale sign of future market movements.

Peeking behind the curtain, we find fascinating case studies where sentiment on SPY Stocktwits has been a harbinger for SPY’s price roller-coaster. Analysts observe the patterns like seasoned meteorologists watching storm systems, trying to forecast the next market deluge or drought.

The toolkit for navigating the murky waters of sentiment data includes sophisticated algorithms and dashboards that visualize the cacophony of SPY Stocktwits chatter. Like a well-oiled machine, these tools help slice through the noise, offering up only the choicest cuts of data.

| Category | Details |

| ETF Name | SPDR S&P 500 ETF Trust |

| Ticker Symbol | SPY |

| Exchange | Listed on NYSE Arca |

| Assets Under Management | Varies (Typically in the hundreds of billions USD) |

| Expense Ratio | Approximately 0.09% |

| Inception Date | January 22, 1993 |

| Objective | To provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500 Index |

| StockTwits Platform | |

| Website | www.stocktwits.com |

| Founded | 2008 |

| Purpose | Social media network for traders and investors to share market insights and sentiment |

| Membership Cost | Free basic membership; optional premium services may vary in cost |

| Features | Real-time market conversations, sentiment tracking, watchlist creation, price alerts |

| SPY Discussion on StockTwits | |

| Sentiment Indicator | Reflects the bullish or bearish mood of discussions related to SPY |

| Message Volume | Metric indicates the quantity of messages tagged with $SPY over a certain time frame |

| Notable Members & Influencers | Traders, analysts, and financial commentators who actively discuss SPY |

TSLA Stocktwits: A Microcosm of Market Fervor

The electric vehicle juggernaut TSLA is not just revving engines on the roads but also on TSLA Stocktwits, where its stock movements send ripples across the SPY pond. The correlation is palpable, sometimes acting like a domino effect poised to tip over markets.

Think of TSLA Stocktwits as a market mood ring; its activity often forecasts the shifts in broader market perception. A tweet here, an earnings report there, and the TSLA tribe on Stocktwits can turn the sentiment tide of SPY faster than you can say ‘market volatility.’

When Musk tweets, the world listens, and SPY often shivers or shines in response. Decoding the instances of Tesla-related breaking news allows market mavens to anticipate the shudders that may follow in SPY’s wake.

Decoding the Symbiosis Between WWF Stock and SPY Stocktwits Chatter

It may seem like an odd pair – the World Wildlife Fund and Wall Street. Yet, the introduction of WWF stock has piqued the interest of socially conscious investors. Their entry has not only diversified the playing field but also added a new flavor to the conversation, resembling a new entry in the Bubblr Flavors of the market.

Discussions around WWF stock on SPY Stocktwits stir up a cauldron of insights, revealing how social impact concerns are intertwined with economic savvy. Investors are eager to see how a conservation-centric organization swims in the shark-infested waters of the stock market.

A deep dive into a case where a piece of environmental legislation sent ripples through WWF stock is as eye-opening as navigating the unpredictable twists and turns of a complex escarole soup recipe. It exemplifies how global conservation efforts resonate within the microcosm of SPY Stocktwits discussions.

Leveraging Big Data in SPY Stocktwits Predictive Analytics

Harnessing the beast of Big Data, predictive analytics whispers secrets about future SPY performance that could be drowned out in the raucous barroom of daily trading. It’s like having your own crystal ball, albeit powered by CPUs rather than magic.

Big Data sweeps through the digital footprints of SPY Stocktwits, much like a beachcomber with a metal detector, uncovering hidden gems among vast stretches of sandy data points. This approach has shown its muscle in magnifying patterns and whispering predictions.

Yet, as powerful as Big Data is, success in prediction is not a guarantee. Like an “exercise program back on track,” it requires continuous refinement and recalibration. The limitations are clear: for every soaring success, there could be an unexpected stumble that brings this high-tech oracle back down to earth.

SPY Stocktwits as a Barometer for Global Economic Health

There’s a strange synchronicity between the babble of SPY Stocktwits and the solemn hum of traditional economic indicators. Like a pressure gauge on the world’s fiscal health, the ebb and flow of discussions on SPY are often an echo of what those indicators whisper.

The ability to cross-reference the ruckus on SPY Stocktwits with economic reports transforms the platform into a sort of 21st-century soothsayer. Like a detective piecing together clues, analysts match the puzzle pieces of tweets and trades with hard data.

When the tectonic plates of global events shift, they send tremors through SPY Stocktwits. Episodes such as trade deals, political unrest, or natural calamities have their tales told through the symbols and syntax of traders’ posts, like a modern-day ticker tape.

The Strategy Playbook: Expert Tips for Engaging With SPY Stocktwits

Experts recommend that newbies approach SPY Stocktwits with a mix of curiosity and caution. Like stepping onto a baseball field for the first time, it’s about learning the rules of the game, listening to the coach, and understanding your teammates.

Seasoned traders spin yarns of experience, offering nuggets of wisdom as precious as oliver anthony Lyrics to the aspiring maestro of the market. They emphasize due diligence, patience, and the art of filtering signal from noise.

Peering into the pandemonium, one learns to spot the difference between a haphazard chorus and a harmonious melody. Discerning the meaningful Croc Heels crunch of data from the irrelevant clutter is an essential skill for any SPY Stocktwits aficionado.

Ethical Considerations and the Fight Against Market Manipulation

The digital age has birthed a new frontier in ethics, one where the line between hype and hope is blurred on SPY Stocktwits. Misinformation can spread like wildfire, igniting concerns about the manipulation of markets and minds.

As these concerns mount, so too do the regulatory responses that aim to shield investors from the potential harm that platforms like SPY Stocktwits could incubate. It’s a dance between freedom of speech and the need to protect the market’s sanctity.

Ensuring integrity is as vital as donning a beret in a Parisian atelier; without it, the true value of SPY Stocktwits could be lost. It’s about maintaining a space that thrives on collective wisdom rather than falling prey to collective folly.

Conclusion: The Prognosis for the SPY Stocktwits Community

After mingling with the masses and dissecting data, it is clear that SPY Stocktwits is not just a forum but a living, breathing organism that feeds on and fuels market trends.

The potential future for SPY Stocktwits and its ilk seems as boundless as the universe, equipped with the ability to democratize investment wisdom while still teetering on the razor’s edge of influence and impact.

The future beckons with open arms, presenting both a challenge and an opportunity to individual traders and the market at large to embrace this phenomenon. With eyes wide open, monitor in hand, and finger on the pulse, the savvy trader acknowledges that in the galactic dance of stocks, platforms like SPY Stocktwits are both the music and the compass.

Unveiling the Secrets of Spy StockTwits Shenanigans

Ah, the bustling digital water cooler that is Spy StockTwits – where traders and investors flock like seagulls to a boardwalk. If you’re ready to take a dive into the choppy waters of investment chatter, let’s shake out some of the wildest nuggets of wisdom from this platform!

The Astro Boy Influence on Trading Sentiments

Hold onto your hats, folks! Did you know that traders on Spy StockTwits can be as optimistic as Astro Boy with a fresh pair of rocket boots when the market’s up? Seriously, when the bulls are running, the vibe is so buoyant; you’d think everyone’s wearing their very own pair of Astro boy Boots. These high-flyin’ moods can turn on a dime though – showing just how sentiment can turbo-boost or slam the brakes on stock talk.

Bouncing Back after a Market Tumble

Picture this: the market takes a nosedive, and Spy StockTwits light up like a Christmas tree! It’s all doom and gloom, but then, out of the blue, comes the voice of reason – someone with the pep talk to get an exercise program back on track ? They’re the coach we never knew we needed, rallying the troops and getting those stock spirits lifted. Remember, a setback is just a setup for a comeback!

The Nicole Avant Factor: Celebrity Spark in the Stock World

Well, I’ll be a monkey’s uncle if celebrity gossip doesn’t creep into Spy StockTwits conversations. You heard it right, pals! Influential figures can stir the pot, sometimes as much as economic indicators do. Have a peek at chatter mentioning the likes of Nicole Avant, and you’ll notice the splash it makes among traders. Whether it’s talk about market-moving tweets or the financial clout of showbiz bigwigs, Spy StockTwits has it all!

Wild Predictions and Pie-in-the-Sky Projections

Ever stumble upon a Spy StockTwits prophecy foretelling a stock soaring to the moon? These outlandish predictions can be as wild as a squirrel on a sugar rush. And while it’s tempting to scoff, sometimes these David Blaine-like traders magically get it right. It’s a rollercoaster, folks, with more ups and downs than a yo-yo championship!

The Cult of the Short Squeeze and Meme Stock Mania

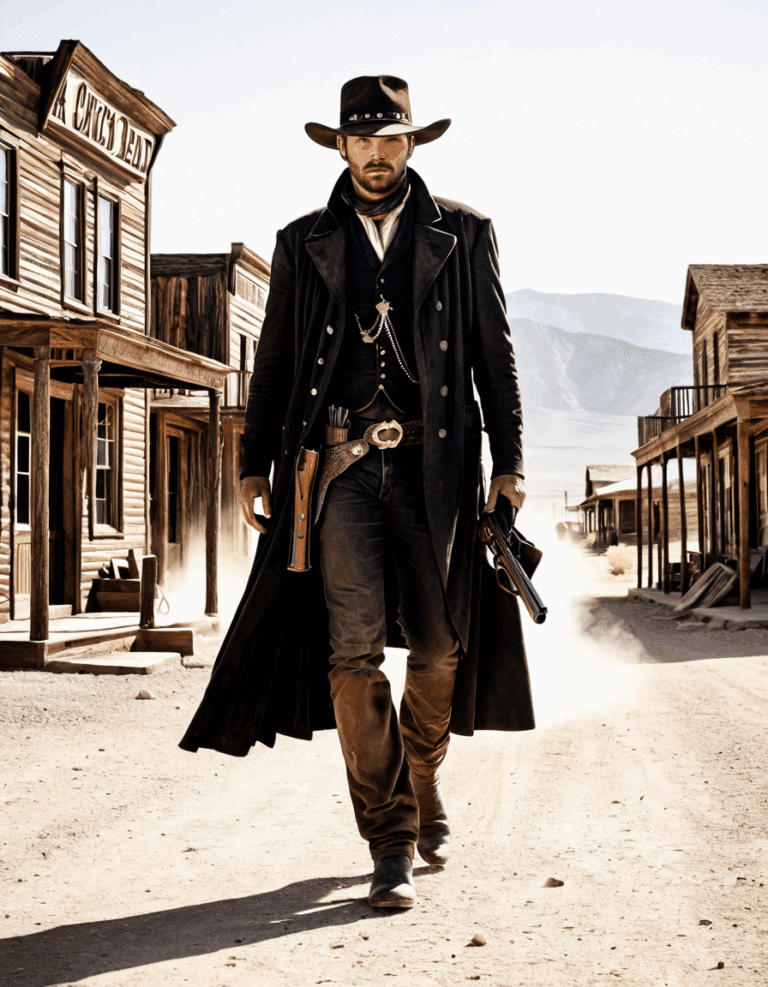

Lastly, let’s gab about the frenzy that grips Spy StockTwits during a good ol’ short squeeze or when meme stocks are strutting their stuff. Traders rally like fans at the Super Bowl, egging each other on as if they’re about to score the winning touchdown. The energy is infectious—people are tossing around hot tips like a hot potato, and you’d think they’ve all found the golden ticket to Willy Wonka’s factory.

There you have it, partners – a jolly jaunt through the wild west of Spy StockTwits. Strap on your seatbelts; it’s quite the rodeo. But always remember: behind every meme, prediction, and sentiment, there’s a stroke of human emotion steering the ship. Keep that in mind, and you’ll navigate these spirited seas like a pro. Happy trading, y’all!