The investment landscape is ever-changing, a realm where fortunes can pivot with the signing of a single deal, and the titans of industry dance a delicate waltz with market trends and investor expectations. Today, we train our gaze on a particularly fascinating subject: Solar Integrated Roofing Corp., hereafter SIRC, whose stock is soaring through the proverbial roof. It’s not every day that we witness a financial spectacle of this scale, so buckle up as we delve into the whys, the hows, and the implications of SIRC stock’s stratospheric climb.

The SIRC Stock Phenomenon: Unpacking the Surge

Understanding SIRC’s Business Model and Recent Performance

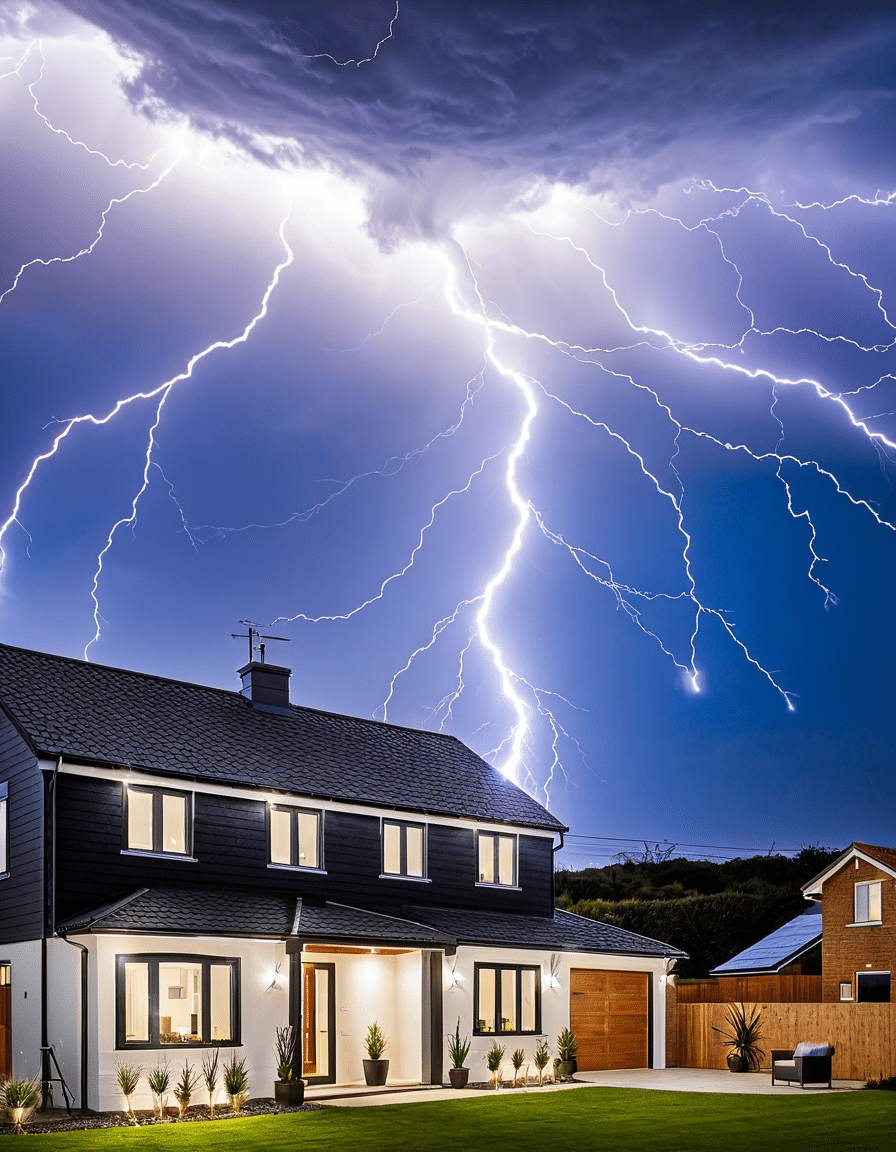

At its core, SIRC is a company that shines – quite literally. Specializing in integrated solar roofing systems, this forward-thinking enterprise has cornered a unique niche in the renewable energy sector. By providing holistic solutions that combine roofing and solar power, SIRC’s business model is as innovative as it is environmentally conscious. And in a world increasingly leaning toward green living, SIRC seems to have hacked the code to both fiscal stability and progressive market meet.

Despite the challenges that often buffet companies aiming to capitalize on new technologies, SIRC’s performance in the business arena has been nothing short of remarkable. In the lead-up to the announcement that put their stock on everyone’s lips, SIRC had been artfully parlaying solid financials with strategic partnerships – a proverbial one-two punch that kept investors on their toes.

Analyzing the Deal that Propelled SIRC Stock to New Heights

Like Taylor Swift’s catchiest tunes, some news just sweeps you off your feet and sticks. For SIRC, such a turning point came with the announcement of their deal, details of which we will examine shortly. It was akin to accessing the tailor swift tour merch of stock market dealings: highly anticipated, extremely valuable, and with the power to mobilize masses.

Exploring the Details of SIRC’s Game-Changing Agreement

Identifying the Key Players in SIRC’s Latest Partnership

A deal as seismic as SIRC’s doesn’t happen in a vacuum, and the key players involved are as much a part of the story as the numbers that will eventually grace financial statements. It’s like the cast Of Zoolander 2 getting together for a sequel – everybody plays a crucial role in the masterpiece or, in this case, market triumph. From visionary CEOs to shrewd COOs, down to the meticulous legal teams, this deal was a herculean endeavor stitched together by the industry’s best.

Terms of the Deal: What Investors Need to Know

In terms of nitty-gritty details, here’s what’s cooking: the agreement inked is one where SIRC is not just crossing t’s and dotting i’s. It’s more like they are underlining, bolding, and italicizing their commitment to growth. Investors, keep your eyes peeled because we’re talking about a strategic partnership that sets SIRC up to potentially redefine energy consumption norms, one solar panel at a time.

Anticipated Financial Impact on SIRC and Stock Valuation

Every investor knows that closing costs are a critical part of any real estate deal, just like they recognize that the financial repercussions of a business transaction are what can make or break an investment. And for SIRC, the digits are dazzling. The deal is anticipated to accelerate revenue streams, diversify product offerings, and expand market reach. Speaking in plain English, it’s good. Real good.

| Item | Description |

| Company Name | Solar Integrated Roofing Corp. |

| Ticker Symbol | SIRC |

| Industry | Solar Energy & Roofing Solutions |

| Event | Investor Update Podcast |

| Date and Time | Thursday, July 20, 2023 (Time not specified) |

| Participants | – Brad Rinehart, CEO – Troy Clymer, President/COO |

| Access | Details regarding access to the podcast are typically provided on the company’s website or through press releases. Investors should look for this information as the date of the podcast approaches. |

| Corporate Update | Mid-Year Corporate Update Letter to Shareholders |

| Contents of Update | CEO Brad Rinehart and President/COO Troy Clymer will provide an update on corporate progress, financials, strategy, and outlook for the rest of the year. |

| Stock Performance (as of last update) | Current price, 52-week high/low, market cap, and other relevant financial metrics (Please note: the reader should check for the latest stock data from financial news outlets or stock market databases.) |

| Recent News | Any significant mergers, acquisitions, partnerships, or contracts the company may have entered into recently. |

| Investor Sentiment | Summary of the analyst ratings, recommendations, and investor sentiment, if available. |

| Guidance (if provided) | Forward-looking statements or financial guidance provided by the company executives. |

| Investment Considerations | – The impact of solar incentives and regulatory changes – Market growth potential for solar and roofing industries – Company’s competitive position and expansion strategy |

Market Reactions: How Investors and Analysts Responded to SIRC’s Announcement

Immediate Impact on SIRC Stock Following the Deal Announcement

When SIRC waved the flag signaling the deal was done, the stock market responded with a symphony of eager beeps as stock tickers scrambled to keep up. It was the fiscal equivalent of “I’m a barbie girl” catching fire on the radio waves – everyone heard it, everyone had thoughts, and boy, was there a lot of dancing.

Analysts’ Opinions and Stock Rating Changes on SIRC

Pull up a chair and let’s talk brass tacks. After SIRC’s announcement, analysts were tripping over themselves to reassess the stock. Upgrades abounded, and ratings shifted favorably, much like Michiel Huismans scenes steal the frame. It was a chorus of financial approvals, a testament to SIRC’s savvy move.

Comparing SIRC’s Stock Rally to Industry Peers

To say SIRC is doing well is like saying the ocean’s a bit on the wet side – a massive understatement. Comparing their stock rally to those of their peers is like juxtaposing a space rocket with hot air balloons. They’re in the same sky but at wildly different altitudes.

Behind the Scenes of SIRC’s Deal: Strategic Moves Leading to the Breakthrough

The Road to the Deal: SIRC’s Negotiation Tactics Revealed

Every monumental agreement has its backstory, the chess moves before the checkmate. SIRC’s negotiation tactics were nothing short of a master class in business strategy. The nimbleness with which they navigated corporate waters was reminiscent of finding commercial Properties For rent near me – seems straightforward but requires finesse and knowledge of the lay of the land.

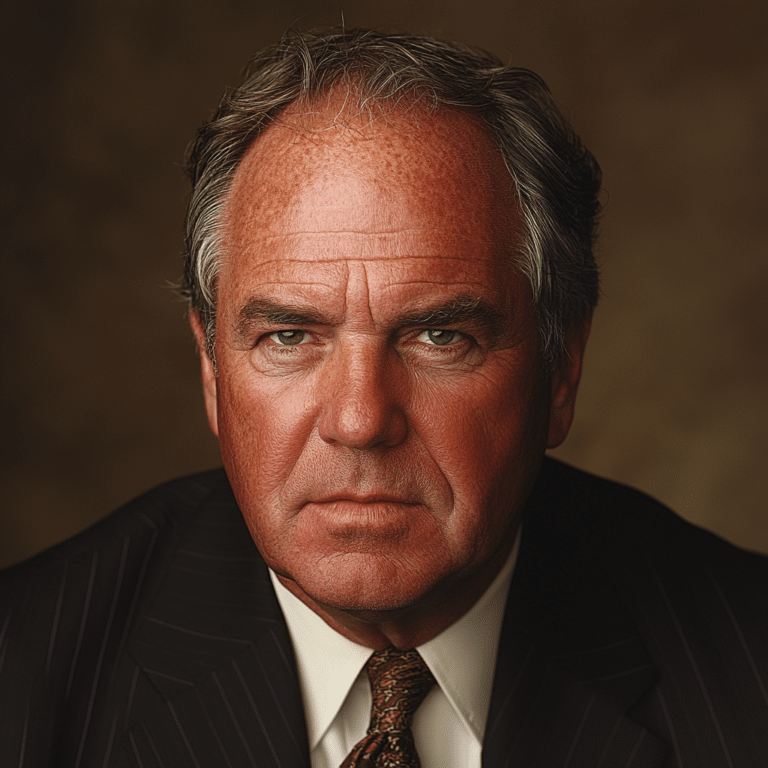

SIRC’s Management Team: Architects of Growth and Deal-making

Meet the maestros, the architects of growth, the managerial minds behind SIRC’s flourishing fortunes. These aren’t your garden-variety executives; these are visionaries with a keen grasp of market rhythms and the tenacity to see the deal through.

Partnerships and Mergers: A Look into Industry Trends

The trend you’re seeing here, the partnership and merger waltz that SIRC is dancing to, is echoed across the renewable energy industry. It’s like the drumbeat of evolution in this fast-moving sector – adapt together, or risk vanishing alone.

The Future of SIRC Stock: What to Expect in the Financial Landscape

Projected Growth Trajectory for SIRC After the Deal

Numbers can be cold, but the projected growth trajectory for SIRC after this deal feels warm to the touch. The figures suggest a steady climb, a bull hard at work who’s not just optimistic but has an itinerary and sunscreen packed for the journey upwards.

Potential Risks and Challenges That Could Affect SIRC Stock

However, in the world of Wall Street, it’s not always sunshine and rainbows. There are risks and challenges afoot that could give SIRC’s stock the sort of grime only the best grill cleaner could tackle. But that’s investment life – glorious but hazardous.

Expert Views on Long-Term Investment Prospects for SIRC

As for long-term investments, experts are humming a tune that’s cautiously optimistic. The kind of melody that’s not a full-blown earworm but lingers pleasantly, suggesting SIRC might just be a wise choice for the patient investor’s portfolio.

Impact on Shareholders and the Broader Economy

Shareholder Reactions to SIRC’s Soaring Stock Value

To say shareholders are elated would be to undersell their reaction. It’s more akin to jubilation, a collective sigh of relief and satisfaction, like spotting an oasis after a long trek in the desert.

Broader Economic Effects of SIRC’s Successful Deal

And it’s not just shareholders who reap the rewards. The ripples of SIRC’s success span the broader economy, bolstering the renewable energy sector, and greasing the wheels of innovation.

Exploring the Ripple Effects in the Renewable Energy Sector

Indeed, the shockwaves sent out by SIRC’s deal are being felt throughout the renewable energy sector, inspiring confidence and demonstrating that green investments can indeed bear golden fruit.

Conclusion: SIRC Stock’s Ascent and Its Implication for the Future of Investment

Key Takeaways from SIRC Stock’s Remarkable Rise

In closing, SIRC stock’s ascent acts as a beacon for what’s possible in the realm of renewable energy investment. The company has not only lit a path for itself but has also illuminated opportunities for others.

The Role of Strategic Deals in Shaping Stock Fortunes

Strategic deals such as the one that SIRC has struck, serve as vital reminders of how fortunes can be shaped, reshaped, and catapulted into the financial stratosphere with the right moves.

The Bigger Picture: Investing in Innovation-Driven Companies

Lastly, SIRC’s tale is a narrative that underlines a broader maxim: investing in innovation-driven companies can be both a boon for the wallet and a vote for a sustainable future. It’s a reminder that the moneymakers of tomorrow are those who dare to envision a brighter, cleaner, more efficient world today – and have the gumption to make it happen.

As the sun sets on our discussion, there’s no denying the spark that SIRC stock has ignited. For investors, stakeholders, and the environmentally conscious, this is a clarion call – one that heralds a future where green is the color of both our planet and our profits.

SIRC Stock Takes Investors On A Roller Coaster Ride

Hold onto your hats, folks — it looks like SIRC stock is climbing faster than a groupie at a Taylor Swift concert! Just like those eager fans scrambling for some exclusive Taylor Swift tour Merch, investors are rushing to get their slice of the SIRC stock pie, and boy, is it a sweet treat!

Have You Heard? SIRC’s Deal Is The Talk Of The Stock Town!

Well, butter my biscuit and call me impressed — what’s got the stock market buzzing like a phone on vibrate mode? SIRC stock, that’s what! It seems that SIRC’s latest deal is more sizzling than a summer barbecue in Texas. And like a perfectly timed punchline, SIRC’s deal raises the bar for how companies make waves in the industry.

Did You Get The Memo On SIRC’s Killer Strategy?

Let’s face it, keeping up with all the technical stock market jargon can be as confusing as explaining a computer definition to your grandma. But here’s the scoop: SIRC’s strategic moves are as on-point as clicking ‘save’ on an important document. It’s like they’ve got the cheat codes to the stock market game, and they’re leveling up big time!

The Economy’s Playing Hard To Get, But SIRC’s Deal Is Winning The Flirt Game

Oh, isn’t it just like the economy to be as unpredictable as the weather on a spring day? But you’ve gotta hand it to SIRC — their deal is wooing the economic powers-that-be like a pro! It’s almost as if SIRC is serenading the market with “I’m a Barbie girl,” because let me tell you, the response is as enthusiastic as a kid in a candy store. And speaking of catchy tunes, check out this chart-topper: I ‘m a Barbie girl, and let me say, it’s as infectious as SIRC’s current market performance!

Bottom Line? SIRC Stock Is The Cat’s Meow

So, what’s the tally at the end of the day? SIRC stock is making waves bigger than the ones at your local beach on a windy day. It’s been on a trajectory that’s left many slack-jawed and impressed, simultaneously. In the grand tapestry that is the stock market, SIRC’s recent deal is a thread that’s not just a blend-in — it’s a standout color that’s catching every eagle-eyed investor’s attention.

Alright, time to wrap this up like a burrito. If you’re thinking about joining the SIRC stock train, you might want to hop on pronto. Remember, stocks can be as unpredictable as a game of musical chairs. One minute you’re sitting pretty, the next you’re left standing. So, keep your eyes peeled and your mouse clicking, because in the world of stocks, it’s always better to be the piper calling the tune.

Who is the CEO of SIRC stock?

Well, buckle up because the CEO of Solar Integrated Roofing Corp., ticker symbol SIRC, is David Massey. He’s at the helm of the clean energy ship, steering the company through the murky waters of the market with a green thumb for eco-friendly initiatives. It’s not all sunshine and rainbows in the stock world, but Massey’s got the chops to try and keep investors grinning!