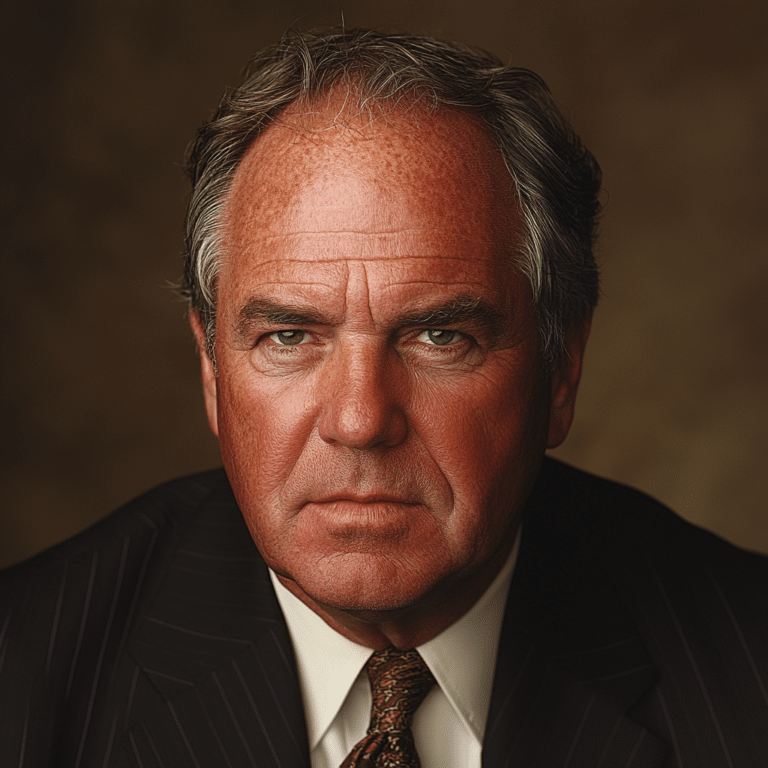

Unveiling the Mastermind Behind a Multi-Billion Dollar Deception: The Story of Paul Daugerdas

In a tale that intertwines genius with greed, Paul Daugerdas, a former accountant and lawyer, orchestrated what would become one of the most audacious tax frauds in American history. His meticulously crafted schemes evaded over $4 billion in taxes owed to the federal government. Once hailed as an unparalleled tax expert, Daugerdas was the architect of a scandal that exposed gaping vulnerabilities in the nation’s legal and financial frameworks.

The Magnitude of the Scam

Paul Daugerdas’ mastery of complex tax structures allowed him to exploit legal loopholes with precision. Like a puppeteer manipulating strings behind a curtain, he directed an orchestra of fraudulent transactions, complex shell companies, and deceitful tax shelters. His maneuvers were not just illegal; they were a blatant defiance of ethical boundaries, proving that when it comes to the pursuit of wealth, some are willing to gamble with the very fabric of societal trust.

The Size and Scale

The scam wasn’t your run-of-the-mill trickery; it was an enterprise on a grand scale—a financial heist fit for the plot of a Hollywood thriller. The sheer volume of fabricated losses and fictitious tax deductions was enough to make one’s head spin. It was the kind of operation that didn’t just bend the rules—it shattered them to pieces.

Paul Daugerdas’ Billion-Dollar Scheme: How It Began

The roots of Daugerdas’ grand deception hark back to an era when tax shelters began sprouting in the darker corners of finance, defying sunlight with their complexity and obscurity. Among these bleak cubicles and dull offices began the birth of a scandal that would eventually rock the pillars of American tax law.

The Early Stages

Starting in the late 1990s, Paul Daugerdas, along with a cadre of clever cohort, began the construction of his financial empire built on smoke and mirrors. Key players—a mix of bankers, lawyers, and accountants—joined hands in this sordid dance of deceit. They targeted the affluent, those with enough cash to want more of it saved away from the taxman’s reach.

Exploring the Loopholes

The financial and legal systems, complex labyrinths in their own right, unwittingly served as the hunting grounds for Daugerdas and his associates. Tax shelters, which are not inherently illegal, can be perverted into something insidious—a fact that Daugerdas exploited with gusto. By navigating through international transactions, trust funds, and dizzying partnerships, he laid the groundwork for his billion-dollar scheme.

| Category | Details |

| Full Name | Paul M. Daugerdas |

| Profession | Lawyer, Certified Public Accountant |

| Alleged Crime | Tax Shelter Fraud |

| Conviction Date | June 24, 2011 (initial conviction, followed by retrials due to juror misconduct) |

| Sentencing | 15 years in prison (as of the last sentencing known at my last update in 2021) |

| Key Affiliation | Formerly a partner at the law firm Jenkens & Gilchrist |

| Areas of Operation | Primarily in Chicago, IL, and New York, NY, USA |

| Tax Loss to Government | Estimated at $1.6 billion |

| Number of Co-Conspirators | At least 5 known co-conspirators, including Denis Field, another principal in case |

| Legal Defense | Maintained innocence; claimed that the tax shelters were legitimate strategies |

| Impact on Career | Disbarment and termination of professional licenses |

| Restitution and Fines | Ordered to pay $164 million in restitution; various fines imposed |

Paul Daugerdas and the Elevation of Tax Fraud to an Art Form

Mastering the Tax Evasion Craft

Paul Daugerdas was not just a beneficiary of this scheme; he was an artist who manipulated the law to paint his profits. He employed an array of complicated financial tools with buzzwords like “COBRA,” “FLIP,” and “OPIS” that only a few could understand, let alone catch onto their deceitful purpose. For years his canvas remained undetected, his brushstrokes too fine for the untrained eye.

The Sophistication and Scale

Daugerdas scaled up the operation to an extent that would elicit awe from even the most seasoned of financial experts. This wasn’t simple sleight of hand; it was a magic act that involved entire industries—banks, law firms, and investment houses. The tentacles of Daugerdas’ schemes extended far beyond any one state’s borders; they were an intricate web spun across the nation, entangling unwitting participants in a shadow dance of money and power.

Shady Operations: The Network and Clients Ensnared by Paul Daugerdas

Paul Daugerdas was like a spider at the center of a vast web, enveloping high-net-worth individuals and corporations looking for tax relief. Through persuasive sales pitches and the allure of seemingly legitimate tax reduction strategies, he lured in clients who, blinded by the promise of wealth preservation, often failed to see the perilous ground they tread upon.

Clients in the Network

From hedge fund managers to real estate moguls, the variety of clients was as diverse as it was affluent. These were not just faceless entities; they were influential figures and institutions who had placed their trust, and their fortunes, in the hands of a man who promised them the world while plotting its plunder.

Daugerdas’ Interaction with Clients

The relationship between Daugerdas and his clientele was a balancing act of trust and deceit. They witnessed the fruits of his strategies in their fattened bank accounts, never suspecting that they were in fact complicit in a crime that would eventually come knocking on their doors. As the fabric of his ruse began to unravel, this circle of luxury and secrecy would eventually turn into a ring of fire, encircling all who had danced too close.

Decoding the Legal Juggernaut: Paul Daugerdas’ Court Proceedings

The Legal Fight against Paul Daugerdas

The courtroom became a battleground where the gavel of justice met the armor of deceit head-on. When the indictment was unfurled, it read like a Shakespearean drama—conspiracy, tax evasion, mail fraud, and a multitude of other charges that hung in the air like a Damoclean sword over Daugerdas’ head.

Trial and Testimonies

Throughout the trial, every card was laid bare on the table. Key testimonies pierced the veil behind which Daugerdas had hidden. Defenses crumbled, and the jury became aware of the man beneath the guise of respectability; a man who had not just crossed the line, but galloped over it with unrestrained audacity.

The Psychological Profile: Understanding Paul Daugerdas’ Motivations

The question on everyone’s lips: What could possibly drive a man like Paul Daugerdas, already lavished with success, to engineer such an elaborate con? Greed, undoubtedly, is a suspect. But is there a deeper chasm within the psyche of such an individual?

Driven by More than Just Greed

It’s not uncommon for those ensnared in the highest echelons of tax fraud to be driven by more than just simple greed. It’s a complex cocktail of power, thrill, and an indomitable belief in one’s own intelligence that can prove to be their ultimate undoing.

Expert Insights

Psychologists point to a blend of narcissism and the intoxicating allure of navigating the world as if it’s a game of chess, with real money for the taking. For Daugerdas, it may have been the seductive challenge of outwitting the system, thumbing his nose at the powers that be, which ultimately spurred his journey into criminal infamy.

The Mechanisms of Detection: How Paul Daugerdas was Eventually Uncovered

Unmasking Paul Daugerdas was no easy feat. The curtain was pulled back not by a singular event but by the relentless pursuit of truth by regulatory bodies. It was a labyrinth of paper trails, each leading to more elaborate cover-ups and dead ends, but like all truths, the nature of his deceit eventually sought the light.

Unearthing the Schemes

The engineers of justice employed their own alchemy of forensic accounting, data analysis, and insider testimonies. Simultaneously, as they tunneled through mountains of obfuscation, whistleblowers emerged, wielding the hatchet of truth against the hitchhiker of fraud.

Challenges of Proof

To craft their case, investigators had to do more than just provide a smoking gun—they had to decipher the layers upon layers of financial transactions, some as labyrinthine as a Justin Mikita modernist sculpture. One could even argue it was akin to decoding a real-life Attacker TV series plot.

Fiscal Repercussions: The Economic Impact of the Daugerdas Scandal

Paul Daugerdas’ actions were not without a severe economic hangover. The loss in government revenue echoed through legislative halls like the shockwaves of a Verizon Layoffs announcement—sudden, severe, and leaving questions about future stability.

The Cost of Greed

Clients who had unwittingly invested in these fraudulent tax shelters found themselves facing harsh financial realities. As the government clawed back lost tax revenue, many faced ruin. It was an expensive lesson that the true cost of white-collar crime reaches far beyond the pockets of the criminals.

Regulation Tightening

In response, financial regulation underwent a barbershop 3 kind of makeover—out with the old, in with the new; rules and scrutiny became tighter than a Taylor Negron directed scene. The reverberations of Daugerdas’ fraudulent enterprise led to significant shifts in tax law, leaving an indelible mark on the annals of financial regulations.

Aftermath of the Storm: Paul Daugerdas’ Legacy in Tax Law and Crime

The fabled I love Amy phrase isn’t just about adoration; it’s about a legacy. In the case of Paul Daugerdas, the legacy left behind was one decorated with the caution tape of crime scene investigators rather than the loving embrace of admirers.

Shifting Legal Tides

Law enforcement offices and tax agencies have since upheld that Daugerdas’ case was not just a closed file but a turning point. Post-Daugerdas, the level of due diligence has been turned up to the maximum, mirrored perhaps only by the security protocols at an Even Hotel.

The Precedent Set

White-collar criminal prosecution was never the same. His conviction stands as a testament to the reach and resolve of the law. No longer can the wealthy and powerful expect to parade egregious tax avoidance without attracting the watchful eye of justice.

Lessons Learned: Preventative Measures Post-Paul Daugerdas’ Scheme

In the aftermath of a storm, one must rebuild with structures stronger and more resilient than before. That’s precisely what the authorities and financial institutions did following the exposure of Daugerdas’ billion-dollar deception.

New Safeguards

Tax authorities no longer rely on the honor system. Instead, they have fortified their arsenals with legal and technological enhancements to spot irregularities before they balloon into full-blown frauds. It is a world where algorithms and vigilance stand guard at the gates of fiscal propriety.

Monitoring and Compliance

The modern-day tax auditor is as comfortable with blockchain analysis as with balance sheets. The advancement of financial monitoring tools parallels the sophistication of those who wish to skirt the boundaries of the law. As such, a balance has been struck to ensure the integrity of a system once beleaguered by the likes of Daugerdas.

Conclusion: The Echoes of a $4 Billion Dollar Scandal

The saga of Paul Daugerdas is a cautionary tale of what happens when intelligence marries immorality. It serves as a stark reminder that the engines of wealth must be lubricated with ethics, not exploited for personal gain. The echoes of his scandal still resonate, a ghostly reminder that this kind of deception can, and did, happen.

A Final Look at Tax Fraud Enforcement

As we venture forward, the legacy of this scandal highlights the importance of vigilance, both within financial systems and the individuals they serve. Is the enforcement of tax fraud where it needs to be? Paul Daugerdas’ downfall suggests progress but stands as a stark warning of the work still ahead.

Ethics in Financial Practice

The path to a future where finance serves its noble purpose is not just about stricter laws or smarter technology; it’s about cultivating a culture that values transparency and responsibility above the whispered promise of ill-gotten gains. Will we take the lessons of Daugerdas to heart, or are we destined to revisit similar scandals? Only time will tell, but one thing is certain—the story of Paul Daugerdas has etched itself into the bedrock of financial infamy, a permanent marker in the annals of what not to emulate.

The Infamous Paul Daugerdas: Mastermind Behind the 4 Billion Dollar Scam

A Twisty Tale of Tax Evasion

Well, well, well, if it isn’t Paul Daugerdas, a name that might not ring a bell like hatchet Wielding hitchhiker, but buckle up ’cause his story’s quite the roller coaster. This chap, a once-revered tax attorney, pulled off a scam so grand it made history books yawn in disbelief. Imagine, if you can, squirreling away a staggering $4 billion – yup, with a ‘B’ – from Uncle Sam’s coffers. It’s the stuff of legends, and not the good kind.

The Devil’s in the Details

Now hold on to your hats, folks, because the devilish details of how Paul Daugerdas operated will make your head spin. The guy was like a maestro, orchestrating tax shelters as if they were child’s play, all while lining his pockets with greenbacks by the truckload. It’s said that meticulous, complex and, frankly, sneaky schemes were his bread and butter. And boy, did he butter his bread well!

But it wasn’t just about the Benjamins for Daugerdas. Oh no, the thrill of the chase, the art of the deal, must’ve felt like hitting a homerun every single day. You know, until the law caught up with him. They always seem to, don’t they?

A Cast of Characters

In every story worth its salt, there’s a cast of characters that turn the plot on its head. With Paul Daugerdas, his accomplices were a motley crew that one would think were ripped straight out of a Hollywood heist movie. Accountants, bankers, advisors – each playing their part in a grand scheme that’d make even the most seasoned of con artists raise an eyebrow.

An Epic Fall from Grace

Oh, what a tangled web we weave when first we practice to deceive! From the towering heights of tycoons to the not-so-glamorous walls of a prison cell, Paul Daugerdas had an epic fall from grace. Let’s just say, folks, the higher you climb, the harder you fall, and Daugerdas hit the ground with a thud heard ’round the financial world.

In the Aftermath

Reality is often stranger than fiction, ain’t it? You could chisel away at the gritty details of Paul Daugerdas’ life and still find yourself scratching your head at how it all unraveled. It’s a stark reminder that, sometimes, life hits you with surprises wilder than a hatchet-wielding hitchhiker.

So there you have it, dear readers, a snippet of trivia and interesting tidbits on the infamous Paul Daugerdas. It’s a tale that’s sure to make you think twice about cutting corners, especially when there’s a cool $4 billion on the line. Remember, no matter how smart you think you are, the truth has a funny way of coming out with its hands up, saying, “You’re nicked, mate!”