Understanding the APPH Stock Phenomenon: A Deep Dive

In the world of agritech, one name that has been catching everyone’s attention is AppHarvest and its accompanying apph stock. At heart, AppHarvest is revolutionizing the concept of farming with a staunch dedication to sustainable practices. Picture a future where indoor farms are not only more typical but also more efficient, slashing resource use and hiking up yields all the while maintaining an eco-friendly approach. It’s a promise that’s as tantalizing to green-thumbed individuals as it is to hard-nosed investors. Not surprisingly, this vision has sent apph stock prices on an almost stratospheric ascent in recent times.

Let’s put it straight – you wouldn’t usually expect such a dramatic rise in a sector often associated with slow and steady growth. But hey, this is a company that’s out to challenge conventional farming stereotypes and, by extension, investment paradigms. So, why has apph stock sprung up like a well-tended beanstalk? Stick around as we unearth the top five reasons behind this phenomenal growth. Trust me; this isn’t something you’d want to gloss over if you’re keen on agritech and the vibrance of forward-looking stocks in this arena.

1. Revolutionary Agritech Developments by AppHarvest

First things first, if you’re pondering the why behind those climbing apph stock digits, look no further than AppHarvest’s impressive suite of agritech innovations. It’s like they’ve gone all-in on a high-stakes poker game against traditional farming methods – and they’re winning.

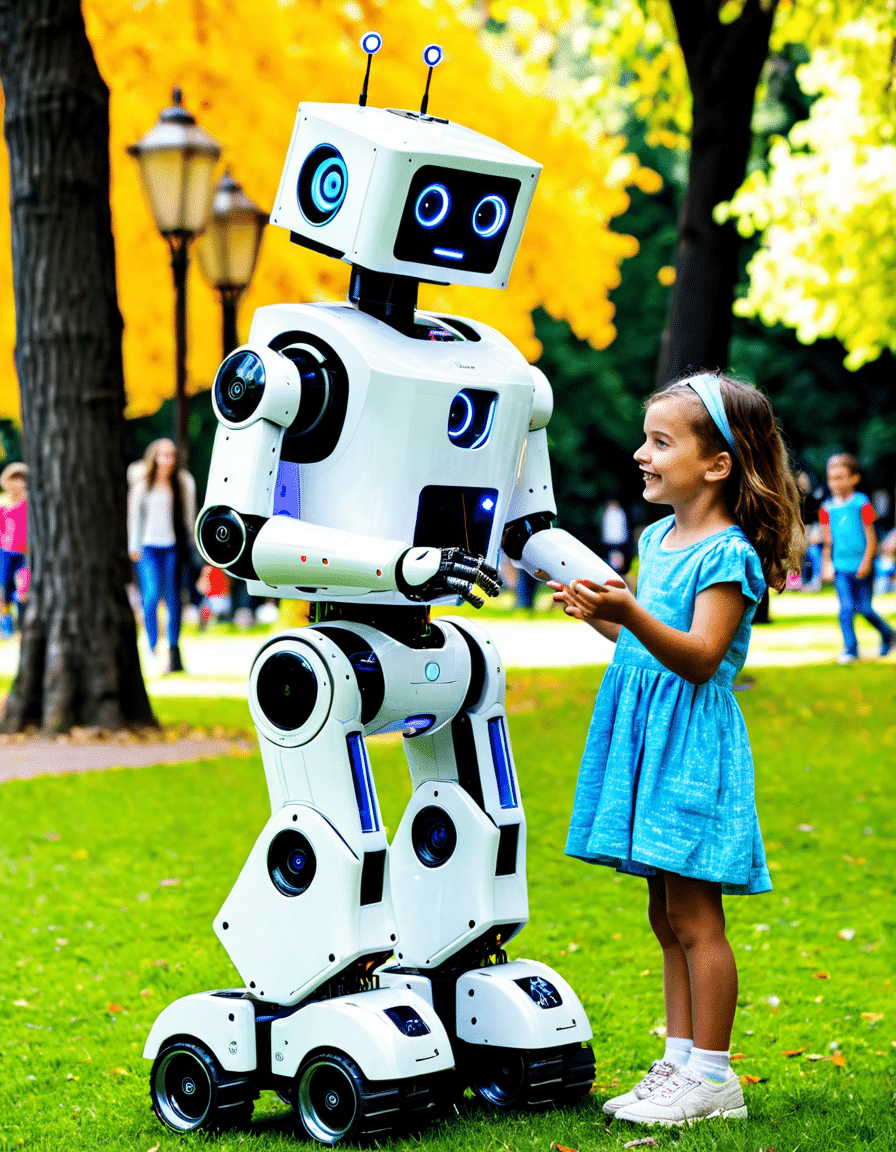

Their tech arsenal? It’s teeming with artificial intelligence and robotics that not only drive up crop yields but also hammer down the costs. Imagine robots that can tell a ripe tomato from a green one or AI that predicts the exact watering needs for acres of crops. It’s that groundbreaking, and it’s changing the way we think about food production.

Did you catch this? With their high-tech greenhouses spanning acres, AppHarvest isn’t playing small. They’re ringing in a new era where technology goes hand in hand with agriculture, and that’s a saga that investors are reading with keen interest.

| Category | Information |

|---|---|

| Company Name | AppHarvest |

| Ticker | APPH |

| Analyst Rating Consensus | Hold (Based on 1 Wall Street Analyst) |

| 12-Month Price Target | Average: $1.50 |

| Price Target Range | High: $2.00, Low: $1.00 |

| Shares Outstanding | 131.12 million |

| Yearly Share Increase | 29.41% |

| Significant Shareholders | Norges Bank, Gmt Capital Corp, KROP, Simplex Trading, LLC, VTWV, Howard Financial Services, Ltd., XTX Topco Ltd, YUMY, Archer Investment Corp |

| Market Focus | AgTech & Sustainable Agriculture |

| Date of Share Information | December 6, 2023 |

2. Strategic Partnerships and Expanded Retail Presence

If revolutionary tech wasn’t enough to pump the stocks, consider AppHarvest’s knack for sealing deal after deal with major players. It’s one thing to grow food sustainably; it’s quite another to ensure that produce sits pretty on grocery shelves nationwide.

With a flick of a pen on several pivotal partnership agreements, AppHarvest has not only broadcasted its ambitions but also cemented its footprint in the retail segment. From big Titles in the supermarket chains to upstart organic outlets, their produce is sprouting up all over, and so are their market shares and – you’ve guessed it – their stock prices.

3. Financial Performance and Positive Earnings Reports

All the tech and partnerships in the world wouldn’t mean a hill of beans if the financial figures didn’t add up. But for AppHarvest, the numbers are as sweet as late-harvest wine. The buzzword here is growth – in revenue, in margins, and a dwindling debt profile that’s had investors toasting to healthier earnings reports.

Now, I’m not just throwing numbers at you to impress you with maths. The recent quarters have been nothing short of an upward financial crescendo for AppHarvest, making those holding apph stock grin from ear to ear. If the books sing green, the shares dance – and right now, they’re doing the tango.

4. Government Support and Sustainable Agriculture Policies

Every farmer knows that the weather can make or break a crop. In the world of agritech stocks, consider government policy the weather. Luckily for AppHarvest, the climate has been fair and bountiful, with sustainability-driven initiatives offering tailwinds.

Government support isn’t just lip service; it translates directly into subsidies, grants, and policies that favor eco-friendly farming practices. In a world desperately seeking greener pastures, such a stance is akin to strolling with the wind at your back—a breeze that’s pushing apph stock ever upward.

5. Insider Buying Activity and Analyst Upgrades

An often-overlooked augury of stock vitality is the action of those with skin in the game – the company insiders. When they start buying up shares, you’d best sit up and take notice. AppHarvest has seen more than its fair share of insider purchases, a clear vote of confidence in the company’s soil-to-market trajectory.

And, of course, there’s the chorus of market analysts. While the consensus leans towards “Hold,” the flutter of activity and the strategic maneuvers enacted by AppHarvest have not gone unnoticed. With price targets meandering around the fertile fields of optimism, it’s little wonder that apph stock has experienced a healthy bloom.

Conclusion: The Growth Trajectory of APPH Stock

In the great tapestry of the stock market, there are companies that neatly fit the patterns and others that boldly embroider their own path. AppHarvest falls soundly in the latter category. This surge we’re witnessing in apph stock, it isn’t just a fluke or flighty speculation. It’s a culmination of bold tech innovations, judicious alliances, steadfast financial growth, supportive agricultural policies, and a hearty sprinkle of insider confidence served with a side of analyst upgrades.

Food for thought? Absolutely. The takeaway here is that AppHarvest isn’t just setting up greenhouses; they’re sowing seeds in the market, betting big on sustainable farming – and from the looks of it, reaping what they’ve sown. As the dawn breaks on a new day for agritech, AppHarvest’s growth trajectory gives us more than a glimpse into the synthesis of nature and technology. And if current trends are anything to go by, we could be looking at a company that’s cultivating not just crops, but also the very future of agritech investment.

Why APPH Stock is Suddenly the Talk of the Town

A Bet on the Future—Literally

So, you’re sitting there, scratching your head wondering why APPH stock is shooting up like a rocket, right? Well, grab yourself a cup of joe, and let’s chat about it. Imagine a world where your veggies are grown not in the dirt, but up in the sky. Sounds like a bet on the future? You bet your boots it does! Much like those innovative companies on the Betr NASDAQ, AppHarvest is all about reinventing farming with high-tech greenhouses and controlled environment agriculture. It’s like they’re planting money trees!

A Stock with More Juice than a Battery

Talk about energizing—the buzz around APPH stock isn’t just empty chatter. These folks have got more potential juiced up than your high-energy batteries. If you’ve been sniffing around the ABML stock, you know the thrill of a company with game-changing tech and a power-packed future. AppHarvest is in that league, folks—bringing a lightning bolt of innovation to the way we grow our greens.

Condolences to the Doubters

Now, to anyone who turned their noses up at APPH stock, thinking it’ll wilt—oh, how the tables have turned. It’s almost time to send out condolences messages to the non-believers. This stock’s growth is giving life to portfolios and making the skeptics eat their words, and possibly, some freshly-picked, sustainably-grown salad!

A Midnight Snack That Feeds Your Portfolio

You know how you sometimes get a hankering for some late night food? Well, investing in APPH stock is like finding the perfect midnight feast—it satisfies your hunger for growth and keeps you coming back for more. Their technology ensures that folks can enjoy the freshest produce, any time, day or night—now that’s what I call a healthy snack for your financial future.

It’s a High Note On the Investment Charts

Just like how Blake Shelton and Gwen Stefani harmony dazzles music charts, APPH stock is hitting high notes on the investment charts. The company’s approach to sustainable farming is harmonizing with investor’s desires to back companies that not only bring in the green (and I don’t just mean lettuce) but also do good for ol’ Mother Earth. It’s a pitch-perfect duo of profitability and sustainability!

A Presidential Seal of Approval?

With all eyes on Presidents Day 2024, could it be that investor confidence in APPH stock is as robust as the reverence for our nation’s leaders? While the presidential holiday might be a ways off, investors are acting as if AppHarvest has received a founding father’s nod of approval, with the stock being paraded around like it’s on its own float down Pennsylvania Avenue.

A Love Story with Growth

And lastly, a bit of a heart-warmer; investing in APPH stock is like the passionate telenovela romance that Adolfo Angel croons about. Investors are falling head over heels for a company whose growth narrative is nothing short of enthralling. It’s a love story with our wallets—an affair to remember, with the pocketbook growth to prove it’s more than just a fling.

So there you have it, friends—the inside scoop peppered with the spice of life. Investing in APPH stock might just be the most engaging plot twist your portfolio has seen in a while. Keep your eyes peeled and your gardens green—this stock’s story has just begun to bloom!

Is AppHarvest a good stock to buy?

Is AppHarvest a good stock to buy?

Whoa, talk about a loaded question! Investing in stocks like AppHarvest can be like riding a roller coaster – thrilling for some, stomach-churning for others! It’s key to remember that what glitters isn’t always gold, and “good” depends on your appetite for risk and your investment goals. Before jumping in, you’d want to pore over their financials, recent news, and potential in the industry. Don’t just take the plunge without testing the waters, right?

What is the target price for Apph stock?

What is the target price for Apph stock?

Well, wouldn’t we all love to have a crystal ball for this? Target prices can be as fickle as the weather – changing with the latest market winds. Financial analysts weigh in now and then, tossing out predictions that can vary more than sock sizes at a flea market. So, for the latest and greatest target prices, you’ll need to do a bit of sleuthing, checking out the most recent analyst reports.

Who are the largest shareholders of AppHarvest?

Who are the largest shareholders of AppHarvest?

Let’s dive into the big fish in the pond, shall we? The largest shareholders in AppHarvest are typically institutional investors who’ve decided to plant their seeds in fertile ground, banking on future growth. You’d find giants like mutual funds, pension funds, and investment firms holding substantial chunks of the company, playing the long game and hoping their green thumbs pay off.

How many shares of Apph are there?

How many shares of Apph are there?

Counting stars or counting shares, both can leave you bleary-eyed! The number of AppHarvest shares floating around out there is a figure that shifts with time, sort of like sand drifting in the desert. As of the latest count, it would be the total number of outstanding shares — so you’d need to check the most recent financial statements or stock market disclosures to get that fresh-off-the-press number.

Why is AppHarvest being sued?

Why is AppHarvest being sued?

Oh boy, trouble in paradise, huh? AppHarvest has found itself in the hot seat with lawsuits alleging some pretty heavy stuff like misleading investors — a definite no-no on the playground of the stock market. Legal eagles claim that the company may have been too rosy with its projections, leaving investors feeling like they were sold magic beans instead of a promising investment. The courts will have to untangle this knot.

Why is AppHarvest stock so low?

Why is AppHarvest stock so low?

Roller coaster alert! AppHarvest’s stock price might be scraping the bottom of the barrel for all sorts of reasons — market jitters, internal company kerfuffles, or maybe investors are just playing hard to get. It’s often a mix of external market factors and the company’s own performance that leads to a case of the stock price blues.

What is the long term forecast for AppHarvest stock?

What is the long term forecast for AppHarvest stock?

Predicting the stock market? That’s like trying to guess how many jellybeans are in the jar! Long-term forecasts are an educated guess at best, mixing a dash of optimism with a pinch of caution. But here’s the skinny: any long-term forecast for AppHarvest would hinge on their success in innovation, sustainability practices, and navigating the ever-turbulent financial seas ahead.

How is AppHarvest doing?

How is AppHarvest doing?

So, you want the skinny on AppHarvest’s report card, eh? Well, it’s a mixed bag. While they’re digging their heels into sustainable farming, and tech-savvy agriculture, their financial health has been under the weather — losses here, a touch of declining revenue there. It’s definitely not all sunshine and rainbows, and they’ve got their work cut out for them, no sugarcoating it.

Where can I buy AppHarvest stock?

Where can I buy AppHarvest stock?

Got your wallet ready? If you’re itching to buy some AppHarvest stock, your ticket to the game is through a brokerage account. These online trading platforms are a dime a dozen — think big names like Robinhood, E*TRADE, or TD Ameritrade. Sign up, log in, and you can be buying AppHarvest shares quicker than you can say “jackpot!”

Can AppHarvest be profitable?

Can AppHarvest be profitable?

Now, that’s the million-dollar question, right? AppHarvest’s path to profitability is like a maze – they need to navigate twists and turns of the agriculture tech sector. With smart moves and a bit of luck, they could turn those red numbers black, but remember, it’s no piece of cake in the world of business, and only time will tell.

What happened to AppHarvest?

What happened to AppHarvest?

AppHarvest’s story has had its share of ups and downs – kind of like a soap opera for the stock market world. From soaring ambitions in sustainable farming to facing the hard truths of financial strain and investor skepticism, their journey’s been chock-full of plot twists. They’re not out for the count yet, but they’ve definitely been through the wringer.

Why is AppHarvest stock going up?

Why is AppHarvest stock going up?

Strap in, something’s brewing! AppHarvest stock’s taking a trip to the moon could be due to a few feel-good headlines, a pat on the back from analysts, or maybe some buzz about their latest farming wizardry. In the stock market’s never-ending telenovela, even a hint of good news can send stocks skipping up the hill.

Who invested in AppHarvest?

Who invested in AppHarvest?

The who’s who of the investing world took a flyer on AppHarvest, placing their bets on a greener future. From social impact funds to celebs with a cause, and heavy-hitting investors looking to sow their dollars where they might bloom into something more – these folks put their chips on the table, crossing their fingers for a jackpot.

Is AppHarvest a penny stock?

Is AppHarvest a penny stock?

Penny for your thoughts? AppHarvest traded for more than a handful of pennies, but their stock has seen prices that might make you think of loose change at times. “Penny stock” is a term usually slapped on shares trading under $5, but whether AppHarvest fits that bill depends on the market’s mood swings. So, best check the latest price tag!

Is AppHarvest delisted?

Is AppHarvest delisted?

As of the latest buzz, AppHarvest wasn’t sent to the stock market’s version of detention – being delisted. But like being on thin ice, companies need to keep their act together to stay listed. Crossing the line with stock exchanges’ rules, or falling short on financial benchmarks can land companies in hot water. Keep an ear to the ground for any updates on their status.